How to Control Inflation and Deflation

How to Control Inflation and Deflation

Control on illegal activities, there are some illegal activities that cause significant inflation in a country. It is hoarding, smuggling, profiteering, black markets etc. In the case of smuggling of large quantities of staples like sugar, butter, wheat, rice etc are exported abroad illegally in order to obtain higher prices. Since oil and food prices can be so volatile, they are omitted from the core Inflation rate. Deflation happens in recession period. If it last for longer period, it harms the growth and development of the economy. Government should adopt policies similar to recession.

Click here to know more about Inflation and Deflation

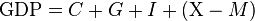

Excess of effective demand, measures to control it imply a reduction in the total effective demand.

Amongst the monetary measures we include higher bank rate, open-market operations, higher reserve requirements, consumer credit control, higher margin requirements, compulsory saving etc.

Fiscal measures with respect to inflation include government spending, taxes, public borrowing, saving, debt management etc. Besides monetary and fiscal measures, there are important non-monetary anti-inflation measures which include output adjustment, suitable wage policy, price control, rationing, etc. These measures are, however, supplementary to main monetary and fiscal measures.

Deflation adversely affects the level of production, business activity and employment and, therefore, it is equally essential to control it. During deflation the bank rate is lowered and securities are purchased through the open market operations and the volume of money and credit is expanded in every possible way. This policy is known as cheap-money policy. The idea is that with an increase in the quantum of money and credit, there will be increase in investment, production and employment. But these monetary measures alone may prove inadequate.

Why Deflation is Worst than Inflation

Why Deflation is Worst than Inflation

Comments

Post a Comment