SLR (Statutory Liquidity Ratio)

SLR (Statutory Liquidity Ratio)

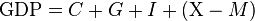

SLR (Statutory Liquidity Ratio) is used by RBI like Repo Rate, Reverse Repo Rate, CRR etc. Does The only difference between Cash Reserve Ratio(CRR) and Statutory Liquidity Ratio(SLR) is that the CRR remains in the cash form with the RBI and the bank has to keep it in the form of SLR gold or government approved securities. Keeping more gold by the bank will reduce the bank's credit and keeping it low will increase its credit.

When the RBI increases the SLR, the bank will have less money to lend us. Currency in the market will decrease. Inflation will decrease.

But in exams it is often asked what is the effect on interest rate due to increase or decrease of SLR, CRR.

So understand this with an example.

- Suppose you have Rs. 100 crores. AAP Manmohan Singh Rs. 100 crores, saying that after a month I get Rs. Returning 101 crores because I take interest at the rate of 1% (1% of Rs. 100cr = 1 crore — 100cr + 1cr = Rs. 101cr) Mannohan ji as usual slipped away from there and after a month he sent you with interest. He also returned all the money.

- But suppose to give you Rs. 100 crores not just Rs. 2 crores only but still you get this Rs. 2 crores as interest from Rs. Want to earn 1 crore So this time 1% interest rate will not work. You have to increase it to 50% (because 50% of 2cr = 1 crore —– 2 + 1 = 3cr)

- Look carefully, when the money you had was Rs. 100 cr. Reduced from Rs. 2 cr. If done, then you had to increase the interest rate of the loan (from 1% to 50%).

Similarly, in our economy when the price of commodities goes up day by day, then RBI- CRR increases SLR and eventually banks have less money to pay us and interest rate in banks is also increased. is. And we will not take loan or take less. Money flow in the economy will reduce.

Repo rate, Reserve repo rate, Bank rate

Go check my other blogs--> Knowledge Track

Comments

Post a Comment