Budget Facts and Types of Budgets

Budget Facts and Types of Budgets

Budget Facts and Types of Budgets

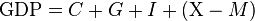

1. The financial year in India is from 1 April to 30 March.2. In the Budget, the government presents the details of these items - income and information, loans, advances, etc.

3. Earlier only one Budget was presented in India. Railway budget was not presented separately before. From 1921, the budget was divided into two parts-

- General Budget,

- Second Rail Budget.

5. The Finance Minister has a speech while presenting the budget. After this, a copy of the budget is laid on the table of the Rajya Sabha. After this, the minister presents the finance bill or budget and the house is adjourned.

204. (2) The Budget shall be presented to the House in such form as the Finance Minister may, after considering the suggestions, if any, of the Estimates Committee, settle

Types of budgetary discussion?

There are two types of budgetary discussion:- General Discussion on Budget

- Discussion on Supplementary grants

1. General Discussion on Budget: - There is a general discussion on the budget first, which lasts for three or four days in both houses of Parliament. In the general discussion, members consider only the general aspects of the government's fiscal and economic policies. The Rajya Sabha has no power other than general discussion in relation to the budget. Voting on demands takes place only in the Lok Sabha.

2. Discussion on Supplementary Grants: - Separate demands are placed for the proposed grants for each ministry. These demands are related to the expenditure part of the budget. The policies and working of the Ministry are closely scrutinized during the discussion on demands. A separate time is fixed for each ministry's demands. At the time of discussion on the Demands for Grants, a cut motion is presented by the members as a subsidiary to the original proposal.

There are three types of cut motion: -

i) Disapproval of Policy Cut: Under this proposal, the government's policy is opposed. In this, it is said that the amount mentioned in the demand amount should be reduced to one rupee.

209. (a) ‘that the amount of the demand be reduced to Re.1 / -’ representing disapproval of the policy underlying the demand.

Such a motion shall be known as ‘Disapproval of Policy Cut’.

Actually it happened to be a way to protest.

Opposition is never in majority. That is why the deduction proposal can never be successful.

ii) Economy Cut: The purpose of this proposal is to reduce the expenditure of the government. It is said that the mentioned amount should be deducted from the amount demanded. Deduction proposals are usually presented by members of the opposition. It simply means that the opposition wants to condemn the government through this proposal.

If the deduction proposal is somehow passed, it is deemed a defeat of the government and there is a demand for his resignation. A day is set by the Business Advisory Committee of Parliament to approve all grant demands. On that day, all the demands, whether discussed or not, are put up for voting. This process is called guillotine. With this, the discussion on the demands of grants ends.

Perhaps you have seen this scene on TV many times.

iii) Token Cut: The purpose of this proposal is to indicate any lack of budget. It is said that out of the demand amount, Rs 100. To be reduced.

Investigation by Departmentally Related Standing Committees (Role of Standing Committees)

Earlier, the demands of grant of two or three ministries were discussed in the House itself and all other government demands for grants were approved without any parliamentary scrutiny. So to end this misconception, in 1994-95, 17 standing committees related to the departments, along with other work, to consider the demands of the grants of the concerned ministries and departments and report to the House before the demands are voted on. Has been assigned the charge of now after the demands are presented before Parliament every year, both the Houses are adjourned for one month so that the concerned Standing Committees can inspect them and submit their report on them.Appropriation Bill

No money can be withdrawn from the Consolidated Fund of India without an Act of Law (without passing an enactment). For this, a bill is introduced in the Lok Sabha which includes all the demands of the grants sanctioned by the Lok Sabha and the charged expenditure on the accumulated funds. This bill is called the Appropriation Bill, ie, the Appropriation Bill means giving the government legal authority for appropriation of expenditure from the Consolidated Fund of India.Finance Bill

A finance bill is one in which all the financial proposals of the government are included for the coming year. This bill is introduced immediately after the presentation of the budget every year. After this bill is introduced, it is necessary to consider it and be passed by the Parliament within 75 days and the permission of the President is required.

Vote on Account

When the budget is presented in Parliament, then discussion on it goes on for a long time. The process of passing the Appropriation Bill and the Finance Bill continues till the start of the current financial year. Therefore, in such a situation it is necessary that the government has enough money to run the country administration.For this, a Vote on Account has been provided by which the Lok Sabha has the power to grant an advance grant for a part of the financial year till the completion of the budget process. Under the Vote on Account, an amount equal to 1/6 part of the estimated expenditure demanded for the entire year is taken for two months. Vote on account is passed when general discussion has been held on the budget and the demand for grants and discussion has already started.

If during any financial year, more than the amount given for that year has been spent on any service, then the President asks for additional amount for such amount in the Lok Sabha.Like a bulb to the railway Rs. Had to buy for 50

But the Railways gets one bulb of Rs.

Had to buy for 100 (100-50 = Rs. 50 straight loss)

All cases of such additional expenditure are brought to the notice of Parliament by the Comptroller and Auditor General (CAG) through its report on Appropriation Accounts and the Public Accounts Committee (PAC) investigates these matters).[alert-announce] The demands for supplementary grants are tabled in the House before the end of the financial year, while the demands for additional grants are actually presented after the expenses have been spent and the end of that financial year. [ / alert-announce]

Vote of credit and Exceptional grants

Due to a national emergency period, the government may require funds to meet the unforeseen demand for funds before which it is not possible to make a grant, in which case the House can give a lump sum through a redemption without giving details. .Under Exceptional Grants, money is sought for a scheme which is a completely new scheme and which is not mentioned in the budget. In such a situation, the House can give a separate amount for that particular purpose.Check other posts also--> Knowledge Track

Comments

Post a Comment