Non-Performing Asset(NPA)

Non-Performing Asset(NPA)

Non-Performing Asset(NPA)

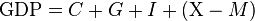

In simple words, when the bank gives a loan to a person, sometimes it happens that the person taking the loan is not able to make regular payment to the bank. Then the bank sends him a notice that brother, you see your own, otherwise the legal action will be taken against you… yet the man does not pay or is able to make it. Now, what action did the bank take against him?But we are going to talk about NPA, so we will talk about NPA. When that man fails to repay the money / interest to the bank, the bank declares that loan as Non-Performing Asset (NPA) (= Bad Loan). You will be surprised to know that as of now there is more than 1 lakh crore NPAs in India.

Debt Recovery Tribunals

- Before the 90s, the bank had to face a lot of difficulties in recovering bad loans.

- Because most of the loan-taking banks had some reaction, before that they used to put the cases on the reverse banks that I was unfair, the loan was given by giving wrong information, etc… .. and these cases used to go on in the civil court… on the date Date… Date on Date….

- So in 1993, the government set up Debt Recovery Tribunals to deal with NPA matters.

- Now borrowers cannot appeal in civil court. His cases run only in Debt Recovery Tribunals (DRT).

- Even though this has facilitated banks, but more than 75 thousand cases are still pending in DRT.

- In 2002, the government brought an act named - SARFAESI Act

SARFAESI Act

The word SARFAESI stands for Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002

Suppose, Gajodhar opened a factory of 100 crores. He brought so much money from the following sources -

Equity (IPO >Shares)

- Own money = 20 crore

- From IPO / Public = 30 crore

Debt (loans, bonds)

- Business loan from Bank = 40 crore

- Bonds = 10 crore

Total = 100 crore.

Initially, Gajodhar's company did well. But from where Gajodhar did his MBA, he forgot all the classes, books and his company started sinking and he is in loss now. Now he was unable to fill the EMI of his bank. The bank sent a notice to him. Nevertheless, Gojadhar was unable to fill the EMI. SBI declared 40 crore rupees as NPA (Non-Performing Asset). Once the loan NPA is declared, the bank can take action to recover the loan under the SARFAESI Act.

Bank has following powers due to SARFAESI Act-

- The bank can seize Gajodhar's assets (commercial, residential, fixed or moving) without a court order.

- Auction / Sale can do its assets.

- If Gajodhar has already sold his asset to a third person, the bank can take all the assets from the third person as well.

- If the third buyer has money from Gojodhar, then banks can also take it.

⇨Under SARFAESI, only a loan of up to 10 lakhs can come.

⇨SARFAESI is applicable only to those assets which are "mortgaged / secured" for availing loans.

If Gajodhar Bhaiya has taken a business loan from the bank, then the bank asks him to keep his factory / machine / vehicles / land etc. as a mortgage.

If Gajodhar Bhaiya has taken a business loan from the bank, then the bank asks him to keep his factory / machine / vehicles / land etc. as a mortgage.

Therefore, the bank cannot take Gajodhar's personal home furniture, expensive wristwatch or his son's bicycle in the name of SARFAESI. Agricultural land is also not included in the SARFAESI Act.

See other post--> Knowledge Track

Comments

Post a Comment