Difference between Gross Domestic Product at Market Price(MP) and Gross Domestic Product at Factor Cost(FC)

Difference between Gross Domestic Product at Market Price(MP) and Gross Domestic Product at Factor Cost(FC)

In the previous article, we learned what GDP is and how to calculate it.

If you didn't seen my previous article then click this link What is GDP and GNP and Methods to calculate it

.

But at the end of that article, I said to be continued so I am writing this article. You must have read about GDP at market price (MC) and GDP at factor price (FC) many times. But the clean language of economics overwhelms us. I do not know why they serve things in books, but some terms of economics are very easy to understand. Take GDP (mp) and GDP (fc) only.

Gross Domestic Product at Market Price

It is clear from the name itself that there is talk of market price here. The price / price of a product or service that we buy from the market. Suppose you and we go to the hotel and eat tandoori roti. When the food starts to rise, the waiter comes and stops the bill. Then we both start arguing about who will give the bill? The bill was a bit high, so I told you okay! It won't work like this next time… I will give it from next time and finally you hand over Rs.600 waiter.So this Rs. What is 600? This is the market price of tandoori. When the government calculates its GDP. Then it combines all those things which are related to market prices (MRP). Remember: - Expenditure method of counting GDP (which I mentioned in previous article).

Now I take the news of your annual expenditure: -

Milk = Rs 10,000 annual

Hotel expenses =Rs 20,000 annual

Expenditure on girlfriend = Rs. 1,00,000 annual

Expenditure on books = Rs. 5,000 annual

Cost on multiplex = Rs 5,000 annual

Expenditure on clothes = Rs. 30,000 annual

Now if I add these expenses to you, then your annual expenditure comes out = Rs. 1,70,000.

Therefore, when the government calculates GDP through Consumption method (C), then you will add all these expenses and tell that India's GDP is 1 lakh 70 thousand (hypothetical figure).

But think that you have spent all this. But you must have gone to someone somewhere or not? Like - near the milkman, near the hotel, near the book.

So did they get all the money you gave them?

If you give Rs. 20,000 to the hotel owner, is the owner of the hotel the entire Rs. 20,000?

Got upset?

Gross Domestic Product at Factor Cost

The owner of the hotel did not get the full twenty thousand of the money given to you. Because in the 20 thousand you gave him, all kinds of taxes were connected. VAT, Service Tax and don't know what…. Suppose the total amount of those taxes is Rs 50. If the owner of the hotel got only Rs 19,550. The remaining money (Rs 50) went to the government.The owner of a factory owes money, wages, interest, bill, rent, tax etc. to the laborer. Have to give. These are his expenses.

Therefore, when calculating the national account, when the factor cost term is used, we have to understand that the government is talking about the money / amount which is without indirect taxes (excise duty, sales tax, customs duty) etc. The producer has finally received.

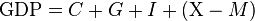

Hence the formula for GDP (fc) is-

GDP (fc) = GDP (mp) - indirect taxes + subsidy OR GDP (fc) = GDP (mp) - net indirect taxes

Here in the formula of factor cost, the subsidy from GDP (mp) was reduced because the government gives subsidy on the sale of some items like- (sugar, rice, LPG cylinder). Subsidy is the exact opposite of tax. The government gives subsidy on the sale of goods to control the market price. The market price of the commodity falls due to subsidy.

For example, the cost of an LPG to the government is Rs. 1,400. Have to bear. Whereas we give him only 700 rupees. Buy in This is the subsidy. We can say in other words that once a commodity is subsidized, its market price is reduced from its factor cost.

- When the economy is flourishing, GDP(MP)> GDP(FC)

- At the time of slowdown, GDP(MP) <GDP(FC)

- Because when there is a slow-down, the indirect tax also falls and the subsidy burden on the government increases.

Conclusion:

GDP Market Price = Factor Cost + Indirect taxes - Subsidies.

In short, MP includes net indirect tax, while FC does not. In other words, FC becomes MP when net indirect tax is added to it. GDP(mp) and GDP(fc) are both the same without indirect tax and subsidy.

Comments

Post a Comment