What is Stagflation

Stagflation

Meaning

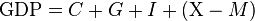

A period of slow economic growth and high unemployment (stagnation) while prices rise (inflation) or Stagflation is an economic situation where the growth rate slows down, unemployment levels remain steadily high & inflation also stays high.In economics, the English word Stagflation refers to a situation when both the inflation rate and the unemployment rate remain high. This is a financially difficult situation for a country, since, at the moment both inflation and economic stability problems arise simultaneously and no macroeconomic policy can simultaneously focus on these problems at the same time can.

The origin of the word stagflation consisting of two-word sounds is generally attributed to British politician Len McLeod, who coined the term in 1965 during one of his speeches in the parliament there. This concept is also notable partly because, in the post-war macro-economic theory, Inflation and recession were considered to be mutually exclusive, and also because stagflation has generally proved to be very difficult and once started, its elimination is very expensive in human terms as well as in budget deficits. A common measure of stagflation in the political arena, called the Misery Index (derived from the combined taxation of the rate of inflation into the unemployment rate), was used to reverse the presidential elections of 1976 and 1980 in the United States.

Economists have provided two major explanations on why stagflation occurs. First, inflationary recession can result when the productive capacity of an economy is reduced by sudden unfavorable supply, such as an increase in oil prices for an oil-importing country. Due to such a sudden unfavorable supply, prices also tend to rise at the same time and at the same time a higher increase in production value and lower profits provide a slower pace to the economy. This type of inflationary downturn brings a policy dilemma because actions that are designed to combat inflation make economic stability worse and vice versa.

Second, both stability and inflation can be the result of unfair macroeconomic policies. Central banks, for example, can cause inflation by allowing excessive development of the money supply, and the government can lead to stability by excessive regulation of the goods market, and labor market, neither of which can cause inflation. May cause recession. Excessive growth in the money supply which is taken to such extreme extent that it has to be reversed suddenly can clearly be a reason. Extreme government policies that increase spending widely, such as protectionist import tariffs, significant increases in environmental regulations or excessive increases in minimum wages, may also be the reason. An analysis of the global stagflation of the 1970s offered both types of explanations: It began with a steep rise in oil prices, but continued even after central banks responded heavily to the resulting recession. Used stimulus monetary policy, resulting in a severe wage-price upturn.

I hope you enjoy reading this. Subscribe to my blog and share as much as you can.

See other blogs also by clicking here-->Knowledge Track

Comments

Post a Comment