Section 7 of RBI Act - RBI Act Explained

Section 7 of RBI Act - RBI Act Explained Role (Section 7 of the RBI Act)

At the time of hearing an appeal in the Allahabad High Court, a case of use of Section 7 (Section 7) of the Reserve Bank of India Act emerged. The suit was filed by the Independent Power Producers Association of India and challenged a circular issued by the Reserve Bank of India (RBI) on 12 February. In the course of hearing, the High Court had made a comment in August that the government may give directions (directions) to the Reserve Bank of India under Section 7 of the RBI Act.

In view of this order of the court, the Government had given a letter to the Governor of the Reserve Bank of India, asking him his intention regarding the exemption given to the energy companies in the context of the circular dated February 12. Apart from this, on October 10, the government had also asked the Governor of the Reserve Bank of India to use the RBI's capital reserves to bring in liquidity.

What is SECTION 7 OF RBI ACT

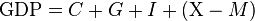

According to Section 7 of the RBI Act, the Central Government has the power to consult the RBI Governor from time to time, to give such instructions to the Reserve Bank of India (RBI), which in its view is necessary in the public interest. "The Central Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider necessary in the public interest," Section 7 (1) of the RBI Act reads.

There is also a sub-section in Section 7 of the RBI Act which states that - "The Government of India may, if it wishes, delegate the general supervision and business of the Bank to a Central Board of Directors which shall do all that the bank does Can work and exercise all the powers of the bank. "

The RBI Board is a body consisting of the following authorities -

- Governor of the Reserve Bank

- Four deputy governors

- Maximum of 10 non-official directors of various sectors nominated by the Government of India

- Two government officials

- One Director each from four local boards of RBI

The ten directors nominated by the Government of India have a term of four years. The tenure of the government officials of the board is till the offerings of the government. Board work

According to RBI rules, the general supervision and guidance of the Reserve Bank's work has been entrusted to this board. In this way, whatever activities the Reserve Bank does, it can also do all activities. The job of the board is also to recommend to the government the outline, size and content of bank notes. When does the board sit?

The Governor of the Reserve Bank convenes a board meeting at least six times a year. This meeting must be held at least once every quarter. If at least four directors wish to do so, the governor has to call a meeting.

If for some reason the governor is not present, then the deputy governor authorized by him presides over the meeting of the board. If there is a division of votes, the governor can also vote for a separate vote, which will be decisive.

Comments

Post a Comment