Goods and Services Tax(GST)

Goods and Services Tax(GST)

The Rajya Sabha passed the Goods and Services Tax(GST) Bill unopposed on 3 August 2016. This bill has already been passed by the Lok Sabha. Thus, this bill has got the approval of both the houses. It is being described as a historical event. Economists say that since 1947, this is a step of India's economic reform. The third meeting of the GST Council was held on 19/10/2016.

In this, it was considered to determine the rate for GST. It was attended by Finance Minister of the Central Government and representatives of various states. No final decision on GST rate could be reached in the meeting. Most states objected to the imposition of additional cess on demerit goods. Now this meeting will again be held on 3-4 November 2016 in which the final decision will be taken on the tax structure of GST.

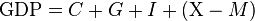

To understand GST (Good and Services Tax) first we have to first understand the tax structure of India. Let's first understand the tax structure of India.

The Indian Constitution has divided Taxation Power into two parts-

- Central Government’s Tax Power

- State Government’s Tax Power

Important Principles of Allocation of Tax Heads Taxes that are of inter-state importance --- >>> will come under the central tax. Taxes that are location-specific and for local consumption —- >>> will come under state tax.

Where is the error in this current tax arrangement?

There are many problems in this tax arrangement. Like we go to the store to get a laptop. We know that the laptop must have been produced in a factory. Therefore, the central government collects the tax from the owner of the company at the time of its production. Then that laptop reaches the shop where I am standing now. Coming to this stage, the state government now imposes VAT on that laptop. Finally, while buying the laptop, I have to bear the taxes imposed by both the central government and the state government. Let us understand this with an example: -Suppose, Daya from CID wants to fix all the doors which he has broken in Mumbai broken. He wants to get the doors installed in those houses. He has pity and self-aggression, so he is determined to do such an act. He thought of getting wood from Assam.

The state has its own tax structure within the border of the state. She sees goods coming from outside states as an import. If Daya door wood is brought from Assam by importing Maharashtra then Daya will have to bear the following taxes: -

a) Where the wood is being cut (saw mill), he has already paid Central and State tax. Therefore Daya will also have to bear both these taxes.

b) When Daya's doors brought Maharashtra, the Maharashtra government recovered the octroi. In this way Daya bore three taxes:

- Excise Tax,

- State tax and

- Octroi Tax.

d) Tax again if you want to sell wood outside the state.

GST has been introduced to remove these double / triple taxation. Now many taxes will be abolished and only one tax GST will remain in their place.

Benefits of GST

Comments

Post a Comment